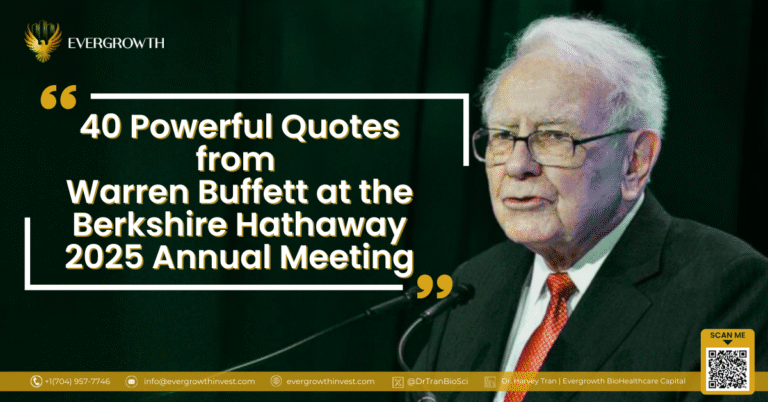

The Berkshire Hathaway 2025 Annual Meeting held on May 3, 2025 marked the end of an era—and the beginning of a new chapter. Warren Buffett confirmed he will step down as CEO by the end of 2025, handing over the reins to Greg Abel, a proven leader with Buffett’s full confidence. Though stepping aside, Buffett...

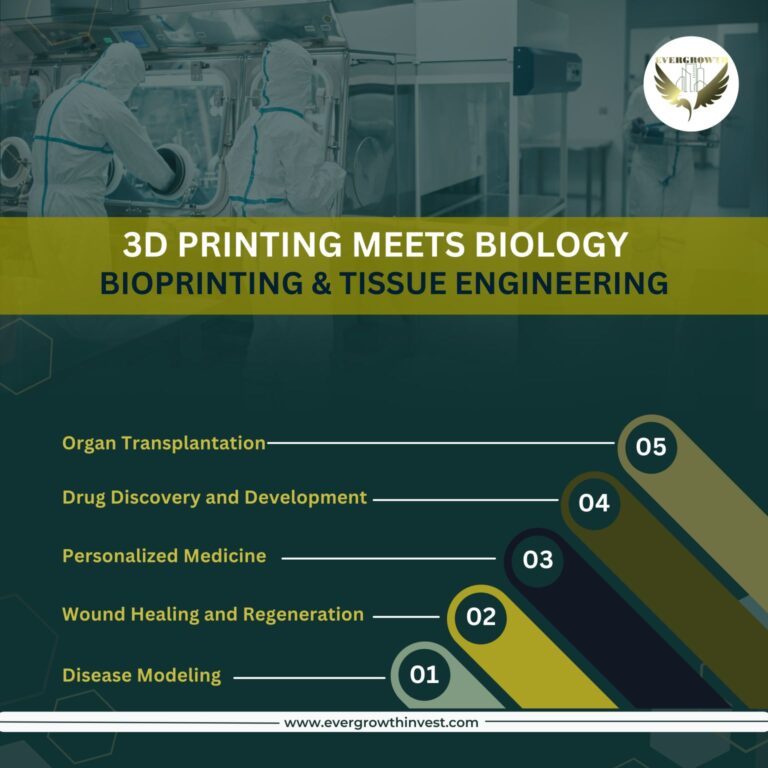

Evergrowth BioHealthcare Capital recognizes the convergence of bioprinting and tissue engineering as a disruptive force in regenerative medicine. This innovative field combines 3D printing technology with biological materials to create functional tissues and organs, offering transformative potential for healthcare and beyond. Investment Opportunities: As a forward-thinking investment firm, Evergrowth BioHealthcare Capital views bioprinting and tissue...

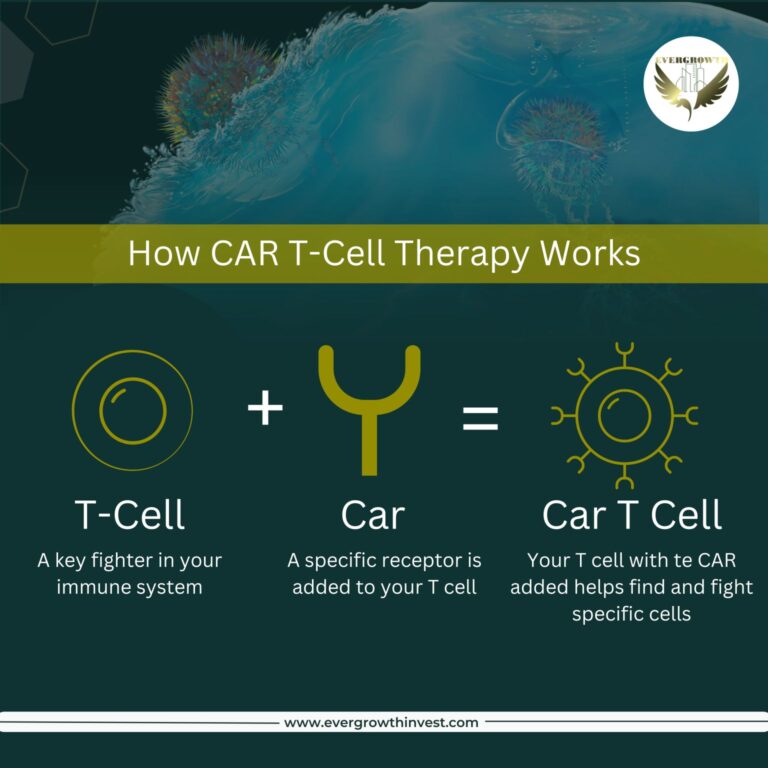

Evergrowth BioHealthcare Capital is investing in the groundbreaking potential of CRISPR/Cas9 technology to revolutionize cancer immunotherapy. By precisely editing the genes of immune cells, CRISPR enables the development of therapies that enhance their ability to target and eliminate cancer cells with unprecedented precision. This targeted approach promises to improve treatment outcomes, reduce side effects, and...

At Evergrowth, we agree with Warren Buffett that patience pays off when it comes to investment. We have no interest in passing market trends or quick profits. Rather, we concentrate on keeping investments for the long term, letting them grow and realize their full potential.For you, that entails the following: Our long-term strategy basically seeks to accomplish...

Dr. Harvey Tran, the mastermind behind the Evergrowth BioHealthcare Capital fund, is a highly-skilled, savvy in the biotechnology industry financial professional.. His investment philosophy, characterized by a unique blend of expertise and intuition, has been instrumental in the fund’s success. The core principles that guide Dr. Tran’s investment decisions are: By combining his experience, analytical...

It combines investing accuracy with drug discovery.Integrated bioscience research utilizes ideas from other domains to improve investment precision and uncover alpha intelligence for drug discovery. The idea of integrated investment is admitting our limits. Physicians may lack financial analytic abilities; financiers may not understand medical complexities; and scientists may be unfamiliar with prescription trends. To...

A data-driven approach in investments involves using qualitative and quantitative analysis combo, diverse data sources, risk management, and performance evaluation to inform decision-making and optimize investment outcomes. Ready to elevate your investment strategy with data-driven insights? Join us at Evergrowth BioHealthcare Capital and unlock the power of informed decision-making in biotech investing.

As we delve into the heart of this fascinating field, it becomes evident that several key trends are shaping its trajectory. These trends not only hold the promise of transforming healthcare but also offer glimpses into a future where the boundaries of possibility are continuously expanding. In this blog, we discuss five pivotal trends that...

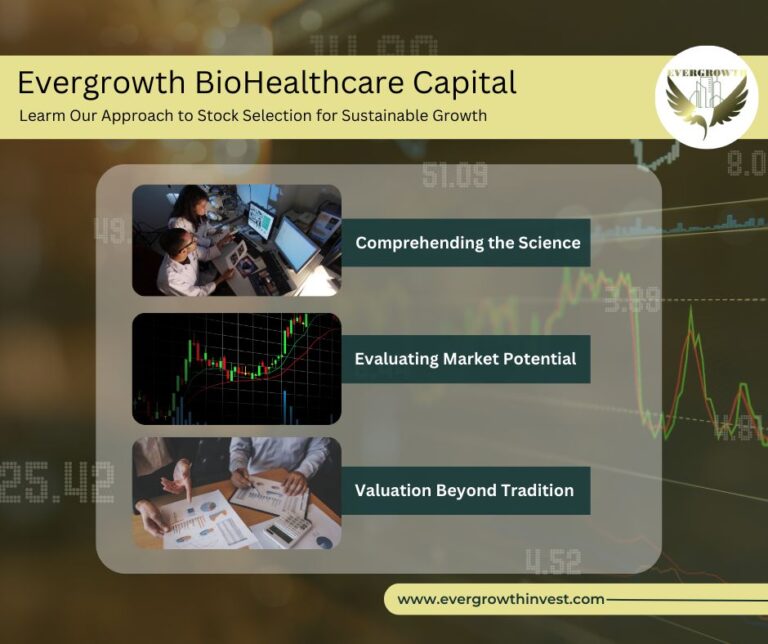

I’m excited to discuss some of our stock-picking techniques! At our fund, we dive deeply into biotech businesses that are in the clinical stage, concentrating on their “Crown Jewel” — the lead medicine that is currently under development. This is the method we use: Comprehending the Science: We assess the medication’s mode of action and its capacity...

Do you know why we focus on the “Crown Jewel”? When discussing biotech investments, the term “crown jewel” usually pertains to the lead or major therapeutic candidate that a business has in its pipeline. This medication is thought to have the highest chance of success and a major effect on the company’s future revenue growth...