Doc, let me ask you this: what pops into your head when you hear “neuroleptics” (you know, those drugs used to treat schizophrenia)? I bet you’re thinking most neuroleptics can handle positive symptoms like hallucinations pretty well, but negative symptoms? That’s a tougher nut to crack. We’re talking flat affect, lack of motivation, and the like. You’d also know that most of these drugs come with hefty side effects—weight gain, extrapyramidal symptoms, the works.

Now, imagine you stumble across a biotech company developing a drug that tackles both positive and negative symptoms with minimal side effects. Wouldn’t you immediately see a golden investment opportunity? I’m betting you’d say hell yes.

That’s exactly what hit me when I first heard about Intra-Cellular Therapies (ITCI) years ago, brought to my attention by clients from my old consulting gig at Integrated BioSci Investing.

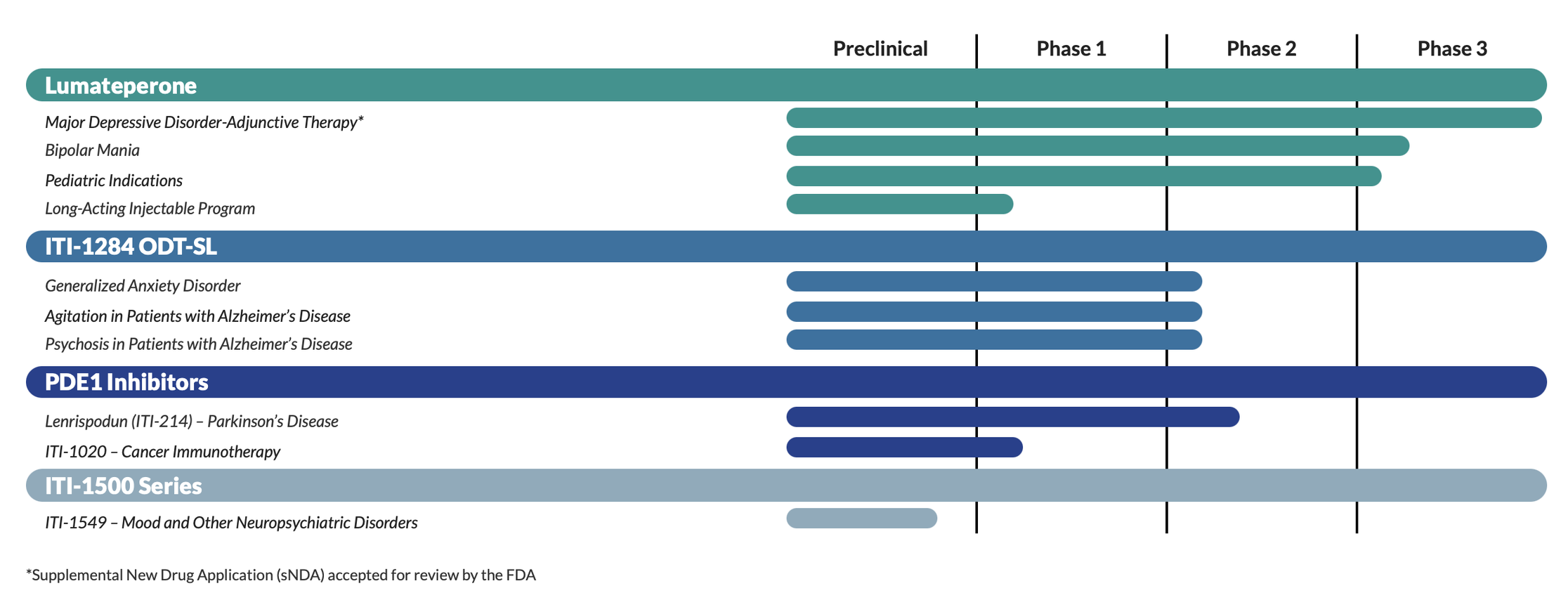

ITCI was a small-cap growth biotech with a compelling pipeline, as shown below. The star of the show—what I call the Crowned Jewel—is lumateperone (aka Luma), the most advanced molecule in their lineup.

When I first came across ITCI, Luma was showing stellar clinical data for treating schizophrenia. I was blown away by its favorable side-effect profile compared to existing drugs. Even more impressive? Luma’s strong efficacy against those tricky negative symptoms. After digging deep, I recommended ITCI to Integrated BioSci Investing clients when the stock was trading at just $8.71.

Marketed as Caplyta, Luma earned FDA approval for schizophrenia in adults on December 20, 2019, backed by clinical trials showing solid symptom reduction on the Positive and Negative Syndrome Scale (PANSS). It hit the market in early 2020.

Then, on December 20, 2021, the FDA expanded Luma’s approval to cover depressive episodes in bipolar I or II disorder (bipolar depression) in adults, both as a standalone treatment and alongside lithium or valproate, based on two strong Phase 3 placebo-controlled trials.

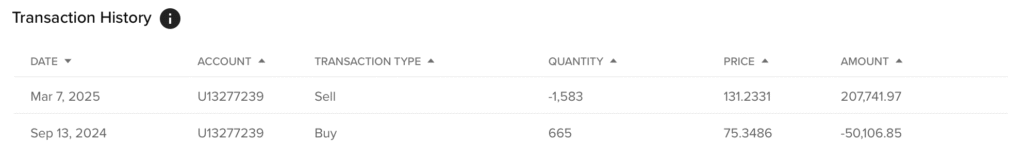

With Caplyta’s sales climbing and more label expansions on the horizon, I scooped up a position for our biotech hedge fund, Evergrowth BioHealthcare Capital, launched in late 2023.

Fast forward to January 13, 2025: news dropped that Johnson & Johnson (JNJ) was acquiring Intra-Cellular Therapies for ~$14.6 billion, at $132.00 per share in cash. The deal closed on April 2, 2025.

Here’s the breakdown: Evergrowth bought 918 shares of ITCI at $60.29 for $55,351.14 in late 2023. With Caplyta on track to blockbuster status, I added 665 shares at $75.34 for $50,106.85 in September 2024. When the acquisition closed on April 2, 2025, we sold all 1,583 shares for $207,741.97. From our total investment of $105,457.99, we walked away with $102,283.98 in gross profits—a 96.98% return.

This play aligns perfectly with Philip Fisher’s (Warren Buffett’s mentor) Point #1: Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years?

Fisher stresses the need for a company to have products with strong growth potential, capable of driving big sales over years in a large, expandable market. With Caplyta hitting ~$700M in annual sales and more label expansions coming, its blockbuster trajectory is clear.

Here’s the kicker: as a healthcare pro, you’ve got a serious edge in biotech investing. You just need to weave that expertise into a solid framework like we do at Evergrowth. We focus on high-quality growth biotech stocks like ITCI and hold them patiently, letting the gains compound over time.

Found this valuable? Follow me and subscribe to this newsletter for more insights. Interested in joining our biotech hedge fund or serving as a Medical Advisor? Visit us at https://evergrowthinvest.com/presentation/.

Want to discuss further? Schedule a free consultation with me at https://calendly.com/drharveytran/evergrowth-introduction?month=2025-05.

Source: https://www.intracellulartherapies.com/medicines/

Disclaimer: This blog is for educational and informational purposes onl

y. It is not a recommendation to buy, sell, or hold any stock. Always consult your investment advisor and conduct thorough due diligence before making investment decisions.

Disclosure: We owned shares of ITCI as mentioned above.

More recent blogs for you: