Hey Doc, let’s take a moment to reflect on your years in medicine. Ever had a patient who seemed stable, only to take a sudden turn for the worse despite your best efforts? Investing in stocks can feel eerily similar. You pour hours into researching that “perfect” stock, convinced it’s a winner, only to watch it crash unexpectedly. Even the legendary Warren Buffett has seen his share of investments go south. So, how do you protect your portfolio from these inevitable curveballs? The answer lies in one word: diversification.

Diversification is your financial safety net, and for busy physicians like you, it’s a must. It’s not about throwing darts at a board; it’s about strategically spreading your investments to balance risk and reward. How much diversification depends on your risk appetite and goals. Want sky-high returns? A concentrated portfolio might tempt you, but it’s a high-wire act with bigger risks. Prefer steady growth and safety? A diversified approach is your friend.

One smart way to diversify is across asset classes. Imagine you’ve got a few million to invest, and you’re aiming for monthly cash flow, modest growth, and high safety. Consider allocating 50% to income-producing real estate, like rental properties, for steady rent checks. Then, split the remaining 50%—say, 25% into index funds or cash/bonds for stability, and 25% into higher-risk, higher-reward stocks like biotech to give your portfolio a growth boost.

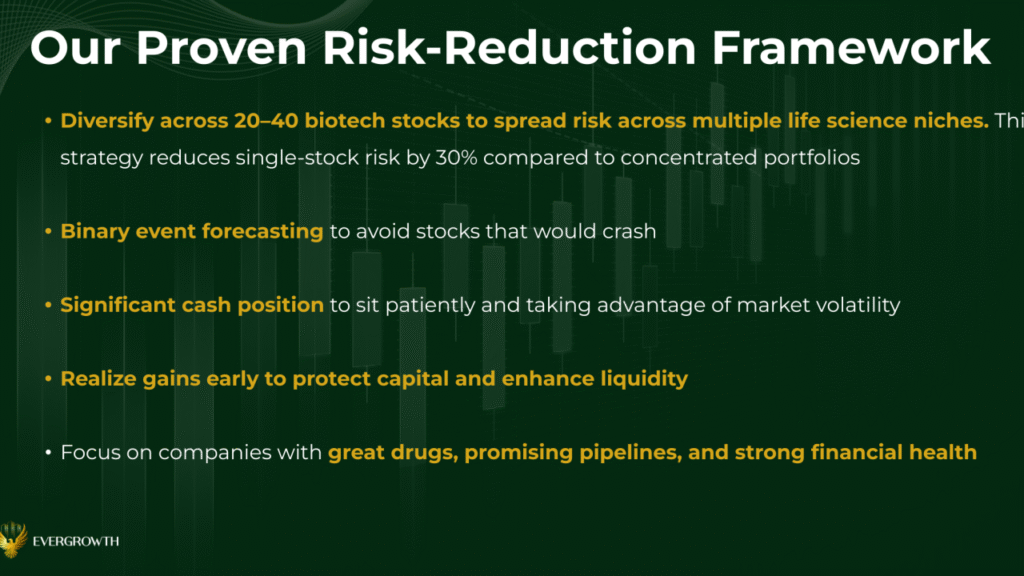

Even within your biotech investments, diversification is key. But how much is enough? Some hedge funds spread their bets across 100+ biotech stocks. At our fund, Evergrowth, we prefer a tighter focus—20 to 40 holdings. Why? Because we know our stocks inside out, like you know your patients. A leaner portfolio keeps costs low (no Wall Street analysts needed) and lets us leverage your unique edge as a physician. Your medical and scientific expertise can spot gems that Wall Street might overlook. Over-diversify, and your returns risk blending into the market average—hardly the goal for a savvy investor like you.

The takeaway? Diversification—whether across asset classes or within your biotech picks—is your shield against the unexpected. It ensures that a few duds won’t derail your portfolio’s success. Just don’t overdo it, or you’ll dilute your edge and settle for mediocre returns. Strike that balance, and you’ll be on track for market-beating wins, all while keeping your financial health as robust as your patients’.

Enjoyed This? Stick Around! Follow me and subscribe to my newsletter for more insights on using your MD advantage in biotech investing.

You pour countless hours into your clinic or hospital, saving lives but often sacrificing your own—your health, your family, your freedom. You’re trading precious time for dollars, with little left for travel or the life you want.

Allow me to ask you the following questions:

- Would more time and money let you live better?

- What if you could change that?

- What if you leveraged your medical expertise to make your hard-earned dollars grow through smart investing?

- Would working smarter, not harder, transform your life?

- How about having a voice in investments that grow your wealth and help your patients?

If any of these hit home, our biotech hedge fund (Evergrowth BioHealthcare Capital)—designed by doctors, for doctors—might be your answer. Here’s what you’d gain by joining us:

- Invest in what you know, using your clinical edge.

- Grow your wealth into generational riches for you and your kids.

- Work fewer hours as your investments take off.

- Retire early to travel and live more.

- Prioritize your health and happiness.

- Connect with other physician investors.

- Support innovations that bring hope to patients on a massive scale.

- Become a Medical Advisor (just one hour a month commitment).

- We only get a small share of your profits, if and only if, we can beat the 8% average stock market performance for you.

Check out our Fund Presentation at https://evergrowthinvest.com/presentation/.

Join our Skool community page at https://www.skool.com/evergrowthbiohealthcarecapital

Schedule a free consultation with me to see if we are the right fit https://calendly.com/drharveytran/evergrowth-introduction?month=2025-05.

Disclaimer: This blog is for educational and informational purposes only. It’s not a recommendation to buy, sell, or hold any stock. Always consult your investment advisor and do your due diligence before investing. In working smarter rather than harder, I wrote an initial draft based on my knowledge, experience, and insight. I then leverage AI to put the information together into this presentable format.

More Reads for You:

- Biotech Investing For Physicians: Why Popular Stocks Could Leave You Holding the Bag https://www.linkedin.com/pulse/biotech-investing-physicians-why-popular-stocks-could-harvey-mxpke/

- Doctors, Are You Trading Hours for Dollars or Building Generational Wealth?https://www.linkedin.com/pulse/doctors-you-trading-hours-dollars-building-wealth-tran-m-d-m-s–466we/

- Biotech Investing: Use Your Medical Expertise to Slash Risks and Boost Returns https://www.linkedin.com/pulse/biotech-investing-use-your-medical-expertise-slash-tran-m-d-m-s–ry4fe/?trackingId=7uIZKG2SRoSWc2tkc3gIzQ%3D%3D

- Doctors, Your Clinical Edge Is Your Investing Superpower: My Telemedicine Win https://www.linkedin.com/pulse/doctors-your-clinical-edge-investing-superpower-my-tran-m-d-m-s–6ivge/

- Your MD Investing Advantage: Why a Biotech’s Sales Partner Is Your Key to Blockbuster Returns https://www.linkedin.com/pulse/your-md-investing-advantage-why-biotechs-sales-key-tran-m-d-m-s–pw1ae/

- Your MD Advantage: Why Antibiotic Stocks Like Melinta Crash and Burn https://www.linkedin.com/pulse/your-md-advantage-why-antibiotic-stocks-like-melinta-harvey-vsqee/

- Why Physicians Are Primed to Spot Biotech Winners: A Potentially Game-Changing Alzheimer’s Test https://www.linkedin.com/pulse/why-physicians-primed-spot-biotech-winners-alzheimers-harvey-csfte/

- Why Physicians and Healthcare Providers Make Great Biotech Investors? https://www.linkedin.com/pulse/why-physicians-healthcare-providers-make-great-tran-m-d-m-s–the0e/

- Don’t Let a Losing Stock Stop You—Here’s Why You Should Keep Investing https://www.linkedin.com/pulse/dont-let-losing-stock-stop-youheres-why-you-should-tran-m-d-m-s–nnxye/