At our fund, strategic portfolio allocation is a dynamic approach to managing risk and maximizing returns. It’s not just about the numbers, but about building a well-rounded strategy for your financial goals.

Here’s the foundation of our approach:

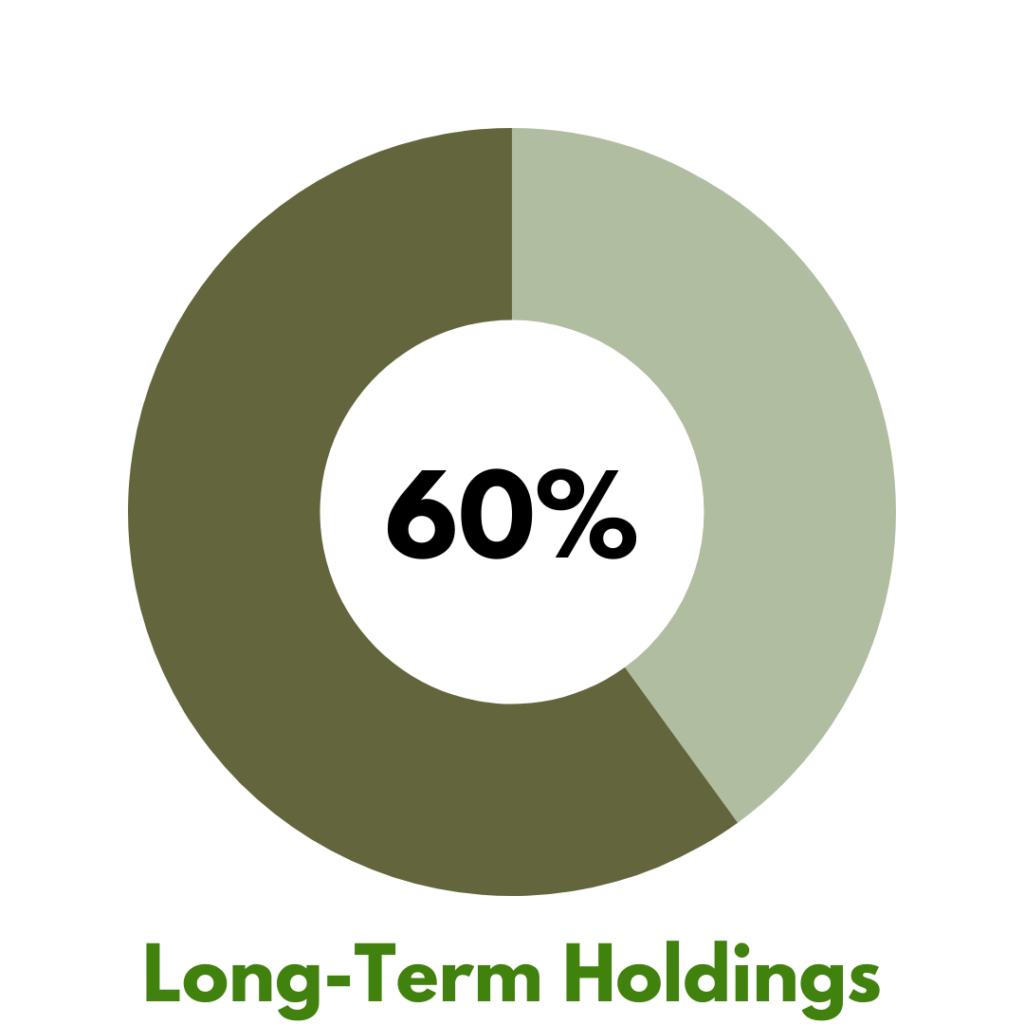

Core Holdings (Majority): These are carefully chosen, long-term investments with a solid track record and growth potential. They form the foundation of your portfolio, providing stability and growth over time.

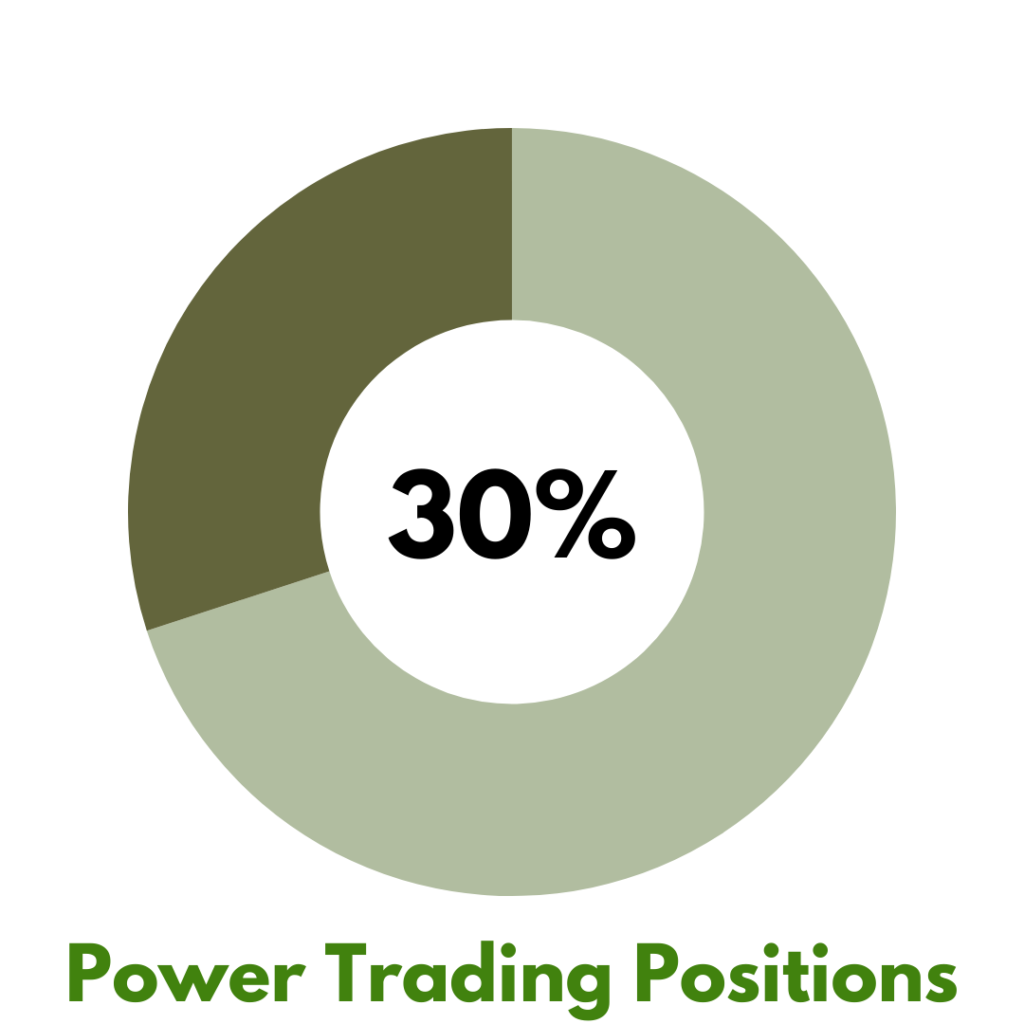

Active Opportunities (Up to 10%): We allocate a portion of the portfolio to capitalizing on market trends or specific opportunities. This might involve strategic investments in specific sectors or utilizing options strategies. We manage these positions actively to maximize returns while controlling risk.

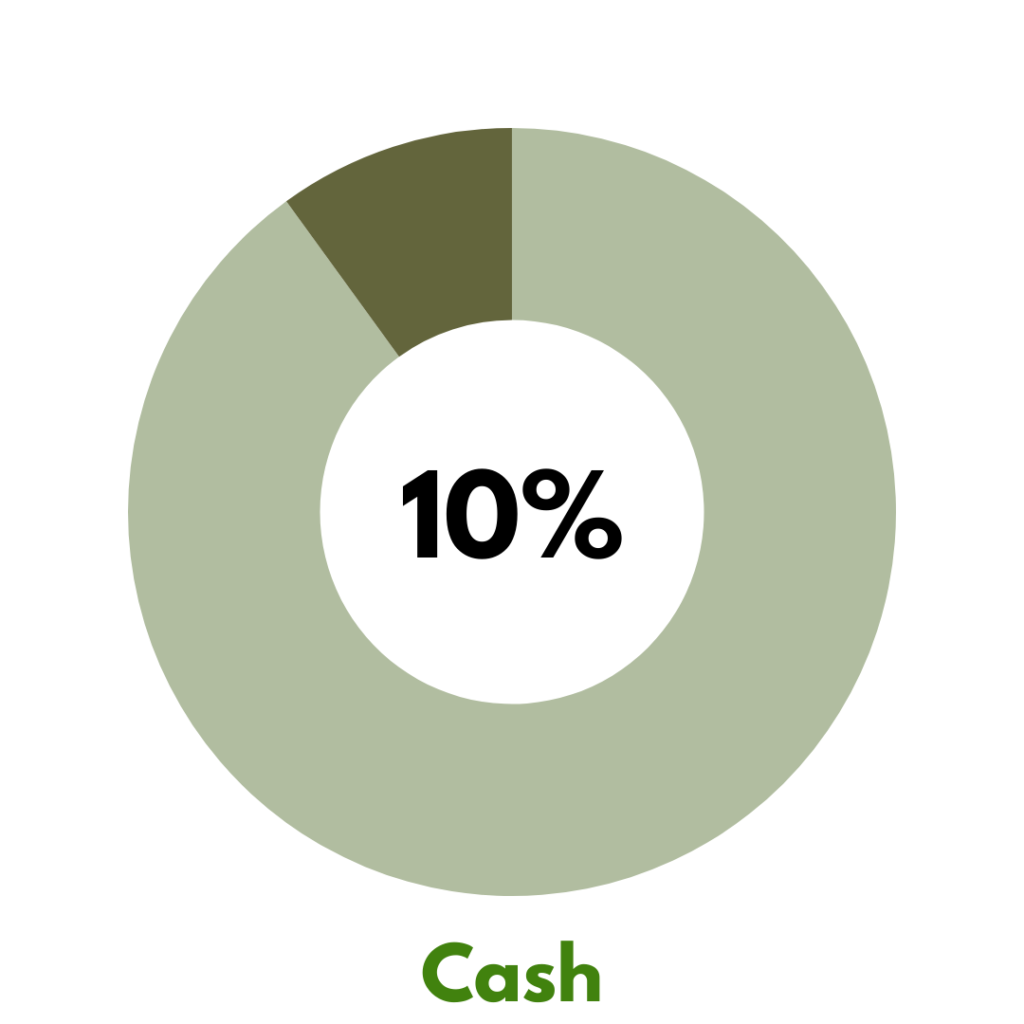

Cash and Cash-Equivalents (Significant Allocation): Having a readily available pool of cash and cash-equivalents is crucial. This allocation allows us to be adaptable and nimble, prepared to invest more funds during market downturns in order to seize significant discounts on attractive investments. Additionally, it allows us to take advantage of unexpected opportunities, whether it’s a compelling new investment or other market situations.

Balance, Flexibility, and Opportunity

Our strategic portfolio allocation prioritizes balance, flexibility, and capitalizing on opportunities while managing risk. This well-rounded approach positions you to weather market fluctuations and pursue your financial goals.